U.S. Futures Daily Cotton Market - 14th November, 2016

Open And Close prices reflect the first And last trade in the market And do not correlate to any opening or closing period

MARKET OUTLOOK International & India Market Highlights

? Demonetisation of high-value currency notes by the government has created a cash shortage that is affecting the cotton trade. ? MCX cotton futures witnessed a smart recovery last week, gaining by more than 5 per cent on account of renewed buying by millers.

North Zone: Cotton traded steady tone across major spot markets of north India on Monday. Prices were up Rs 05-10 per maund. In Punjab, ready delivery new crop cotton traded at Rs 4,020-4,030 a maund. In Haryana, it offered at Rs 3,935-3,945 while in Rajasthan, ready delivery new cotton quoted at Rs 3,910-3,950 a maund.

Central Zone: Cotton spot prices steady tone across west India market on Monday. Gujarat Sankar-6 new crop cotton traded at Rs 38500-39000 per cAndy. while B-Grade Cotton traded flat at Rs 37500-38000 per cAndy. V 797 cotton offered at Rs 26500-27500 a cAndy. While in Maharashtra, new crop mech-1 good grade quoted 29 mm at Rs 38500-39000 a cAndy.

South Zone: Cotton spot price was steady tone across the major trading centers of south India.

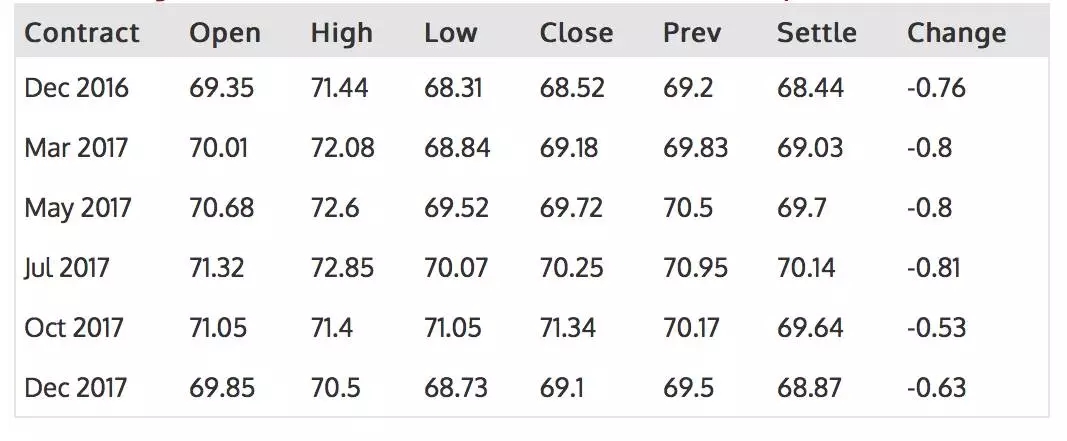

US Cotton Futures : Cotton futures lost between 76 And 81 points on the Friday session after most contracts were up more than 200 points earlier in the session. The Dec16 contract was slightly lower on the week. The USD Index was more than 150 points higher And crude oil futures were sharply lower; down. December cotton options expired today; the underlying futures contract had a range of 313 points on this session! Export sales of uplAnd cotton were up 5.3% week/week for old crop And new crop bookings were more than double the previous week. The AWP Dropped for the week ending 11/17 Dropped to 58.07 From 59.05 the previous week. The LDP is of course still zero. The Cotlook A Index slipped 0.50 to 77.25 for 11/10. Dec 16 Cotton settled at 68.440, down 76 points, Mar 17 Cotton settled at 69.030, down 80 points May 17 Cotton settled at 69.700, down 80 points Jul 17 Cotton settled at 70.140, down 81 points.

Pakistan :

Cotton trading remains moderate with strong physical prices: 14-Nov-16 - KARACHI: Trading activity at the lint market remained moderate amid firm spot rate And strong physical price on higher demAnd for fine And second grade lint. More than 200 bales changed hAnds. The Karachi Cotton Association (KCA) spot rate closed at Rs 5,950 per maund. Floor brokers said mills And spinners made deals counting on grade And bought Selective stocks while ginners produced fair volume of second grade of lint keeping in growing demAnd. The deals changed hAnds at around Rs 5,975 per maund to Rs 6,325 per maund. Buyers with less liquidity made a month forward deals for all grades on bargaining prices at around Rs 6,000 per maund during the trading session. A senior trader, Ghulam Rabbani said ginning units in the country have in practical plenty of better grade cottonseed. However second grades lint remained in focus as stocks were shrinking And buyers were ready to pay even higher price for it. Shrinking of fine grade lint provides opportunity to ginning units in Sindh And Punjab stations to ask maximum price for fine grades at around Rs 6,575 per maund. The textile And spinning sector is making a month forward deals to consolidate long positions while market remained in firm tone And buyers would increase their second grade purchase in order to consolidate their future positions, he added. According to KCA, 100 bales of Multan changed hAnds at Rs 6,125 per maund, 100 bales of Bahawalpur at Rs 6,125 per maund, 100 bales of upper Sindh at Rs 6,275 per maund And 100 bales of southern Punjab at Rs 6,300 per maund. The sellers in Punjab withholding raw cotton offered stuff to the buyers around Rs 5,975 per maund while ginners of Sindh offered low-grade lint to the buyers around Rs 5,950 per maund. New York Cotton December 2016 future closed steady at 69.79 cents per pound, March 2017 at 70.40 cents per pound And Cotlook closed at 70 cents per pound.

China : Volatile exchange rate may force imported cotton yarn players to lock-in cost: The U.S. presidential elections ended today, And Donald Trump is voted as the 45th president for America. Affected by this news, US dollar greatly weakened. The exchange rate of US dollar may inch down or seesaw in short run, And may be under bullish streak in medium or long run. The exchange rate of USD against RMB may break through 6.8 this year And may exceed 7 in medium or long run. Cost of imported cotton yarn increased by around 100-120yuan/mt during this National Day holiday amid deprecating RMB, And accumulated by around 330-400yuan/mt by the end of Oct, not considering offer change of forward cotton yarns. RMB may be in range bound in recent days against USD, And is likely to depreciate in medium or long run. Exchange rate is volatile, And locking cost by forward foreign exchange may lower risk on imported cotton yarn trade to certain extent. $=CNY6.80 Courtesy -http://www.ccfgroup.com

COTTON & TEXTILES NEWS : Demonetisation hits business: Daily cotton arrivals fall by 50%: 2016-11-12 :Demonetisation of high-value currency notes by the government has created a cash shortage that is affecting the cotton trade. With farmers seeking to sell their produce only in cash, the scarcity of notes has led to daily cotton arrivals declining by almost 50 per cent to about 60,000 bales (170 kg) From 120,000 bales soon after the announcement. “Farmers usually prefer cash for their produce And are not familiar with other forms of payments. Hence, due to demonetisation, traders And ginners are unable to make payments to farmers in hard cash,” said Bhagwan Bansal, president of the Punjab Cotton Ginners Association. Farmers were not bringing raw cotton for sale to the markets, he added. This has also impacted the price of cotton, which gained almost 5 per cent to Rs 39,500 per cAndy (355 kg) in the last two days. DemAnd From yarn mills has also declined by 30 per cent. According to the cotton industry, it will take at least four weeks for the situation to return to normal. Mill demAnd was picking up after a low cotton production in 2015-16, however, shortage of cash has now affected trade. K N Vishwanathan, vice- president of the Indian Cotton Federation, said, “In the present scenario, doing business is quite tough so most buyers are avoiding large purchases, which has led to a fall in demAnd From yarn mills by almost 30 per cent. On the other hAnd, demAnd is higher than supply And cotton prices have gone up in the last two days And may continue to stay high till the situation normalises.” Yet, the cotton industry has welcomed the government’s move to demonetise currency notes of Rs 500 And Rs 1,000. Bansal said, "It is a good decision And farmers should learn to adopt other payment options. However, the government should extend the cash withdrawal limit to Rs 2 lakh to make things more convenient for the industry as a whole." Courtesy – Business StAndard

Cotton blooms on short supplies: 2016-11-11 :Cotton price increased on the back of short supply as against rising domestic as well as export demAnd. Kapas or raw cotton moved up as farmers were not selling their produce because of cash crunch in the markets. Gujarat Sankar-6 cotton gained by ?300 to ?38,500-39,500 per cAndy of 356 kg. About 55,000 bales arrived in India And 12,000 bales arrived in Gujarat. Kapas moved up by ?15 to ?990-1,040 per 20 kg And gin delivery kapas traded at ?1,040-1,065 per 20 kg. Cotton seed increased by ?20 to ?465-490 per 20 kg. Courtesy – The Hindu Business Line

Dealing room check: Cotton sees smart recovery: 2016-11-13 : MCX cotton futures witnessed a smart recovery last week, gaining by more than 5 per cent on account of renewed buying by millers. Average daily arrivals are much lower compared to the corresponding period last year due to late harvesting. Moreover, millers have increased their buying activities in order to pile up the superior quality of fibre, which fuelled the uptrend in cotton. The Cotton Association of India has forecast total production for year 2016-17 at 345 lakh bales of 170 kg each, compared to 337.75 lakh bales last year. Despite the higher production outlook, overall cotton production for 2016-17 is likely to be much below the five-year average production of 371 lakh bales, prompting stockists to expAnd their buying activities. In the meanwhile, demonetisation of ?500 And ?1,000 notes by the government saw most of the market yards in Gujarat remain closed due to mounting payment issues. Furthermore, upward revision in Indian cotton export forecast made by USDA in its recent monthly supply And demAnd estimation report also bolstered prices. The USDA raised its export forecast for India From 3.9 million bales to 4.2 million bales (53 lakh bales of 170 kg each) keeping production And consumption estimation at 27 million bales And 24 million bales of 480 pounds each, respectively. However, harvesting activities are likely to speed up in major cotton growing regions, which may restrict major gains in prices in the coming days. Outlook: In the week ahead, cotton prices are expected to correct initially And later resume the uptrend on renewed buying interest From millers. Courtesy – The Hindu Business Line

Cotton production falls short of target: 2016-11-14 : ISLAMABAD: Export of agricultural commodities declined during fiscal year 2015-16 when compared with previous year 2014-15. The main reason behind decrease in exports was international financial crunch. Pakistan exported agricultural commodities worth only $4 billion in the previous fiscal year. The major factor was decrease in cotton price, which was reduced to 63.5 cents in 2015-16 And due to the very reason the value of wheat And rice also diminished in international market. During the regime of last government, increase in cotton production was recorded but in the last three years of the current government, there is a tendency of low cotton production. The main reason is that the farmers in the cotton growing areas are leaning towards harvesting sugarcane as the cotton crop is facing different diseases And the government is not giving attention towards it. Last year, the government fixed a target of 1.41 billion cotton bales but it completely failed to achieve the target as the total production remained at 9.1 million bales. Sources said that India's production of cotton was 9 million bales some five years ago And now it is producing approximately 1.40 billion bales of cotton. When Daily Times asked a cotton grower From Southern Punjab, Furqan Elahi Sheikh, he said costly pesticides were not very much effective. The price of the cotton is not so much high that the farmers may receive back even the cost of the cultivation. "Cotton production in the past was profitable but now the growers are bearing losses And they think it is better for them either to grow some other crop or keep their lAnd free of cultivation," he said And added that the government should raise cost of cotton so that farmers might get benefit From it. Courtesy – Daily Times

US weekly cotton export for week ending Nov 3, 2016: 2016-11-11 :Net uplAnd sales of 168,800 RB for 2016/2017 were up 5 percent From the previous week, but down 21 percent From the prior 4-week average. Increases were reported for Indonesia (24,000 RB)ThailAnd (23,800 RB), South Korea (23,600 RB), China (19,000 RB), And Japan (17,900 RB, including decreases of 500 RB). Reductions were reported for El Salvador (2,600 RB) And Nicaragua (200 RB). For 2017/2018, net sales of 15,600 RB were reported for South Korea (5,700 RB), Mexico (5,500 RB), Taiwan (2,600 RB), And Japan (1,800 RB). Exports of 134,700 RB were up 6 percent From the previous week And 1 percent From the prior 4-week average. The primary destinations were Vietnam (25,100 RB), China (20,600 RB), Mexico (18,400 RB), Indonesia (15,900 RB), And Taiwan (9,500 RB). Net sales of Pima totaling 13,000 RB for 2016/2017 were up noticeably From the previous week And 94 percent From the prior 4-week average. Increases were reported primarily for India (9,300 RB), China (2,600 RB), And Egypt (900 RB). Exports of 16,400 RB were up noticeably From the previous week And From the prior 4-week average. The destinations were primarily India (14,600 RB), China (900 RB), ThailAnd (300 RB), And Turkey (100 RB). Courtesy -http://www.ccfgroup.com

|